Expand Your Business with Equipment Financing

Don’t let the cost of new equipment hold you back. Our equipment financing and leasing solutions are designed to help you acquire the machinery, technology, and vehicles your business needs to grow. With tailored terms and competitive rates, you can get the tools you need without draining your working capital.

Key Advantages

- Funding for both new and used equipment.

- Lease or purchase options to fit your needs.

- Preserve working capital for daily operations.

Equipment Financing Options

- Get up to $150,000 for equipment that’s critical for running your business

- Lease new or pre-owned equipment

Improve Efficiency

- Help operations run smoother with new equipment

- Keep your working capital to fund other important parts of your business

No Limitations

- Lease about any type of new or pre-owned equipment

- You decide what equipment your business really needs

Quick, Painless Process

- Get funding fast so you can make important purchases quickly

- Flexible payment options are available

Equipment Financing & Leasing Details

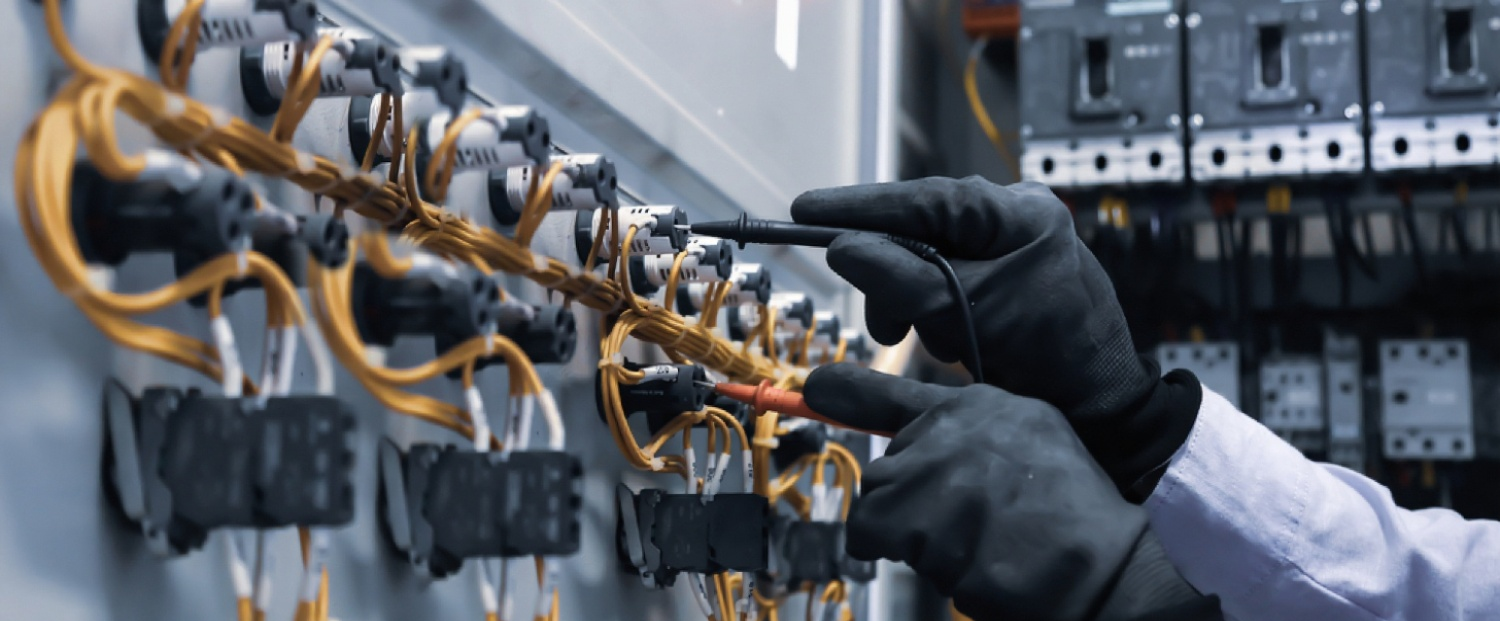

Unexpected equipment repairs or upgrades can have a significant impact on your business. From heavy equipment like forklifts to large medical equipment, having the equipment you need is an important part of your business’s success. The cost of equipment purchases don’t have to be prohibitive – with equipment financing and leasing, you can get up to $150,000 in funding for new or pre-owned equipment. At Glavisloan, you’ll be able to take advantage of our Lowest Payment Guarantee and no down payment requirements. Our dedicated Funding Specialists are committed to securing fast approvals and the best possible terms for your business.

Qualifications for Equipment Financing

6 months

in business

Fair to

Excellent Credit

Equipment quote

from a vendor

How to Apply

Applying for equipment financing from Glavisloan is easy. Simply fill out our quick and easy online application and one of our friendly Funding Specialists will contact you to learn more about your business. Your Funding Specialist can help you decide which financing option is a good fit for your business regardless of whether you need equipment financing or a small business loan. Once you apply for equipment financing, you’ll receive an answer in as little as 24 hours.

Apply

Now

Apply

Now

or call 888.733.2383

Types of Equipment Financing

Financing for medical equipment, practice expansion, and specialized staff.

Commercial Fleet Vehicle Financing & Business Auto Loans

Capital to cover everything from kitchen renovations to daily inventory and payroll.

Restaurants & Food Service

Access funding for inventory, marketing, and expansion of your storefront or online business.

Beauty

Get loans for fleet upgrades, vehicle maintenance, and fuel costs.

Gym

Get loans for fleet upgrades, vehicle maintenance, and fuel costs.

Agriculture

Finance new machinery, raw materials, and operational costs to boost production.